"Cryptocurrency Federal Credit Union"

A non-profit, member-owned financial institution that specializes in personal and business accounts for cryptocurrency users.(Please note: This is a conceptual name only. There has been no application made with the National Federal Credit Union Association at this time.)

Project overview

In the United States, both individuals and businesses involved in cryptocurrency face real challenges in maintaining relationships with financial institutions. One reason may be because these institutions see cryptocurrency as a threat to their viability and business models (which in many ways it is). However, we believe that most of the reason is due to the high regulatory and supervisory burdens associated with cryptocurrency-related transactions, which are often seen by regulators as “high risk” transactions. Numerous reporting and compliance requirements, including anti-money laundering and countering the financing of terrorism (AML/CFT) requirements, are often time-consuming, manual processes performed by smaller financial institutions, while larger institutions often view this extra effort for a minute subset of its accounts as not worth it from a ROI perspective.

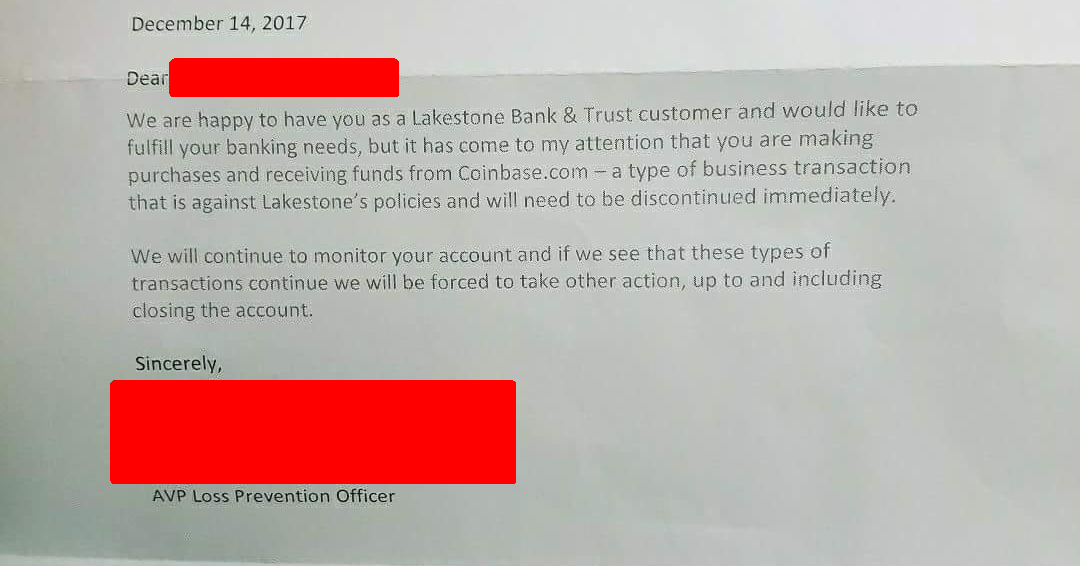

Legacy banks sure do love crypto assets.

As you can see, the letter above illustrates this problem which has not abated over time. In fact, though it is difficult to know for sure, evidence suggests that this practice may have increased as banks have become more aware of cryptocurrency exchange businesses in recent years.

This project, “Cryptocurrency Federal Credit Union” (working name), proposes to investigate, and if deemed feasible and with sufficient community support, seek a federal credit union charter from the National Credit Union Association (NCUA). If successfully chartered, the business created would be a federal credit union, a type of financial institution that is owned by, and can pay dividends to, its members, which can include U.S.-based individuals and their businesses. The institution would specialize in the types of “high risk” compliance that is integral to current regulations for accounts that transact cryptocurrency. It would be able to offer the full array of services that a federal credit union can legally offer, including savings and checking accounts, debit cards, ACH settlement, merchant services, etc.

It should be noted that a federal credit union would be unlikely, under current regulations, to allow accounts to be denominated in any cryptocurrency. Until and unless regulations allowed for it, accounts would be based in fiat currency. However, it is clear that a reliable financial institution that specializes in working with members who transact in cryptocurrency would be a beneficial addition to the ecosystem. We believe a member-owned credit union to be appealing to more of the cryptocurrency ecosystem than a traditional chartered bank. While the eventual goal of cryptocurrency is to eliminate much of the need for traditional financial institutions, the need exists today for a reliable financial institution to help bridge the gap for those consumers and businesses that deal heavily in cryptocurrency. Such an entity can help existing consumers and businesses in the cryptocurrency ecosystem, as well as enable easier launches for new people and businesses entering the field.

We have conducted informal discussions with credit union advisors that indicate that a credit union may be able to be chartered if there is enough interest among those that would be included in the scope of membership. However, without formally contracting with some advisors and experts, we are unable to conduct further work on this project.

- Incubation phase one: Initial contracting with experts to design and implement a survey to determine if sufficient interest exists to pursue further.

- Incubation phase two: If it is deemed feasible, the work would be done to make application for a federal credit union charter.

If the charter is granted, the entity would then conduct the work needed to begin operations.

Incubation period

- Incubation phase one: We estimate that it would take no more than six months to develop and conduct a survey of the scope of membership and to analyze its results. The results would be made public and then a determination on proceeding to phase two would be made.

- Incubation phase two: We estimate it would take two years or less to complete the credit union charter application process. Some federal credit union charters have been granted in as little as one year, but two years is a precautionary timeframe. Once chartered, the period to become operational would be approximately six months. Once operational, it is likely that the credit union entity would increase its portfolio of services as it matured.

Incubation budget

- Incubation phase one: We project that the cost of designing, implementing, promoting, and analyzing a survey of the potential scope of membership to be no more than $50,000.00 USD.

- Incubation phase two: We project that the cost for preparing the application and business plan needed to secure a federal credit union charter to be about $250,000.00 USD. Startup and initial operational expenses for the federal credit union, if the charter was issued, are estimated to be an additional approximate $250,000.00 USD.

If the application for a credit union charter was not granted, of course the second half of the incubation phase two costs would not be incurred. Based on our initial consultations with NCUA and credit union professionals, it is likely that a credit union charter application, if presented with all required business planning and other supporting information, would be granted. However, this is not guaranteed, and it is possible that political issues relating to cryptocurrency could slow down or complicate the process. We determined that it is more likely to receive a charter from the National Credit Union Association for a federal credit union than a national bank charter through the Office of the Comptroller of the Currency. Funds for a proposed federal credit union (PFCU) must come from donated sources, including donations from BTRIC to the PFCU entity, grants, and other sources of financial and in-kind contributions.

Project partners

During incubation phase one, BTRIC will partner with a credit union consultant, marketers, and media organizations in the cryptocurrency ecosystem to distribute the survey widely.

If this project progresses to incubation phase two, BTRIC plans to partner with consultants with expertise in credit union startups and work closely with the NCUA and other credit union industry groups to prepare the organization and materials for its charter application.

Launch method

If the project advances to incubation phase two, a separate PFCU entity would be created. This organization would be structured as advised by the consultants with expertise in credit union startups. This entity would very likely be a non-profit organization with a Board of Trustees. During the incubation process, we will identify persons that would be committed to serve as Trustees as well as others that would eventually be employed to operate and manage the credit union if the charter is granted.

Assuming the charter application is successful, the launch of the federal credit union would be promoted through marketers and media in the cryptocurrency ecosystem.

Help Make "Cryptocurrency Federal Credit Union" a Reality

For a limited time, BTRIC is conducting our launch fundraising campaign. When you contribute as a Founding Donor, we give you BTRIC Founding Donor (BFD) Tokens. You also have the opportunity to be listed and recognized as a Founding Donor. We accept fiat and cryptocurrencies. This is a limited-time opportunity to participate as a Founding Donor and receive BFD Tokens.

Holders of BFD Tokens will receive a free grant of “BTRIC Coin” when it launches later this year. In addition, on an ongoing basis, holders of BFD Tokens receive rewards from “Cryptocurrency Federal Credit Union” and every other project that completes our Innovations Incubator program (not only the projects we are working on now, this also includes every future project). It’s our way of returning valuable benefits and rewards to holders of BFD Tokens as recognition for supporting our launch.